stsl component|Changes to STSL calculations effective from 9 August : Cebu Learn how to withhold the study and training support loans component from your employee's earnings if they have a HELP, VSL, FS, SSL or TSL debt. Use the tax table, the lookup tool or . Winter Dental in Arvada, CO offers quality, comprehensive dental care to meet the needs of patients in the Arvada area.

[email protected]; Emergency? Call For an Appointment; Pay Online; . Winter Dental. 8605 Ralston Road Arvada, CO 80002 View Map. Hours. Monday: 8:00am–5:00pm Tuesday: 8:00am–5:00pm

stsl component,Hun 23, 2022 — Find out how to withhold the study and training support loans component from your employee's earnings if they have a SSL debt. Use the lookup tool or the formula to calculate the monthly amount to withhold.

Learn how to withhold the study and training support loans component from your employee's earnings if they have a HELP, VSL, FS, SSL or TSL debt. Use the tax table, the lookup tool or .

Hun 23, 2022 — Example 1. Employee has claimed the tax-free threshold and has weekly earnings of $1,095.84. STSL component = $1,095.99 × 2% = $22.00 rounded to the nearest dollar. .Using a formula. The withholding amounts for employees who have a study and training support loans debt can be expressed in a mathematical form. If you have developed your own payroll .Statement of formulas for calculating study and training support loans components. The coefficients in this schedule should be used together with the Statement of formulas for .Using a formula. The withholding amounts for employees who have a study and training support loans debt can be expressed in a mathematical form. If you have developed your own payroll .Trade Support Loan ( TSL). Employees can choose to have their STSL amount calculated using one of 2 options: Calculated on taxable earnings; or. Calculated on repayment income. What is taxable earnings? Taxable earnings are all .Ago 9, 2021 — Learn how to choose between taxable earnings and repayment income for study and training support loans (STSL) deductions in Your Payroll (AU) pay runs. Find out the reasons, benefits and drawbacks of each method .stsl component Changes to STSL calculations effective from 9 August May 23, 2022 — Although the official tax scales are not changing for the 2022/23 financial year, the Study and Training Support Loans (STSL, previously known as HECS, HELP and SFSS) rates .Hul 17, 2024 — STSL tax is a tax you withhold from your employee’s pay when they have government-funded study and training loans such as HECS-HELP. Learn how STSL tax works, what loans are included, and how to report to the .

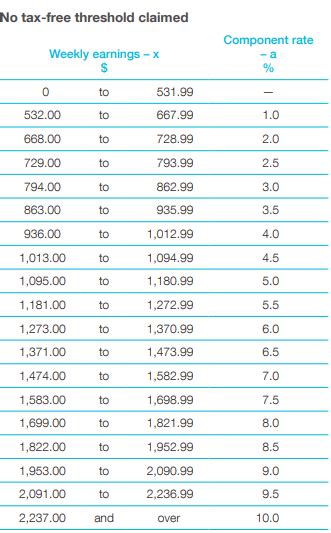

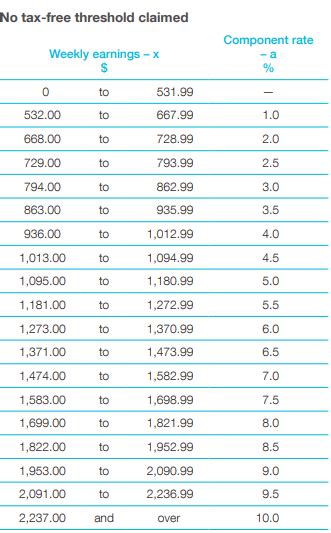

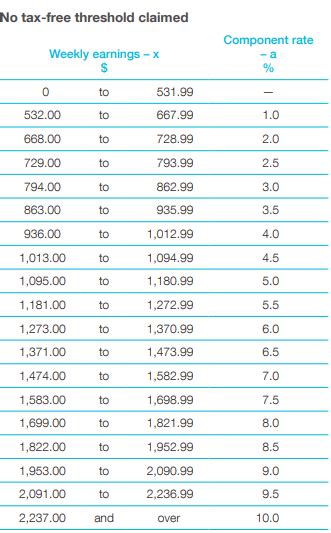

Hun 23, 2022 — Use this study and training support loans weekly tax table to calculate the study and training support loans component to withhold. Add the study and training support loans component to the withholding amount. Withhold this amount from your employee's earnings. Finding the study and training support loans weekly componentHun 14, 2023 — Weekly STSL component = $1,266.99 × 2.5% = $32.00 rounded to the nearest dollar. Monthly STSL component = $139.00 ($32.00 × 13 ÷ 3, rounded to the nearest dollar). End of example. Do not withhold any amount for study and training support loans debts from lump sum termination payments.Ago 9, 2021 — Where before, STSL was calculated on taxable earnings this was changed to being calculated on repayment income. Effective from 9 August 2021, we will be introducing another change to the method used to calculate an .STSL component = $1,095.99 × 2% = $22.00 rounded to the nearest dollar. 2 Employee has claimed the tax-free threshold and has fortnightly earnings of $2,355.78. Weekly equivalent of $2,355.78 = $1,177.99 ($2,355.78 ÷ 2, ignoring cents and adding 99 cents). Weekly STSL component = $1,177.99 × 3% = $35.00 rounded to the nearest dollar.Abr 6, 2022 — As of last year, HECS/HELP/STSL/SSL/TST are all referred to as either income contingent loans (ICL), or study and training support loans (STSL). Most payroll software uses STSL. How it works is that your employer withholds extra tax from your pay each payrun. Then when you lodge your tax return and we can work out the exact amount you need to .

Peb 6, 2024 — Hi Anne, It's not possible to record the additional contributions that will display as STSL component on a payslip. When the 'Upwards Variation Requested' option is selected in the Taxes tab, this can not be marked as STSL so it'll need to be communicated to the ATO when it is paid that it is for STSL.Set 24, 2020 — Estimate the compulsory repayment amount required for your study or training loan.

stsl componentAbr 7, 2021 — What is Study Training and Support Loans(STSL)?The government provides financial assistance (in the form of loans) like STSL to people undertaking higher education, trade apprenticeships and other training programs. Information on the different type of loans that fall into the STSL category can be found here. . a is the value of the component .STSL component = $1,095.99 × 2% = $22.00 rounded to the nearest dollar. Example 2 – fortnighly earnings. Employee has claimed the tax-free threshold . and has fortnightly earnings of $2,355.78. Weekly equivalent of $2,355.78 = $1,177.99 ($2,355.78 ÷ 2, ignoring cents and adding 99 cents) Weekly STSL component = $1,177.99 × 2.5% = $29.00The amount used when calculating the STSL amount in a pay run depends on the pay run's frequency. You can access the ATO-STSL tax tables here based on the applicable pay frequency: Weekly. Fortnightly. Monthly. You can also refer to the ATO's component look-up feature provided here to determine STSL calculations. If you require confirmation of .Weekly STSL component = $1,312.99 × 2.5% = $33.00 rounded to the nearest dollar. Monthly STSL component = $143.00 ($33.00 × 13 ÷ 3, rounded to the nearest dollar). Do not withhold any amount for study and training support loans debts from lump sum termination payments.Nob 24, 2023 — The STSL tax has two components: the loan itself which is taken by the student to cover costs, and the tax component which is required to be paid back after crossing an income threshold. The tax component involves a .Abr 30, 2023 — How and when compulsory repayments of your study and training support loan are made through the income tax system.

Changes to STSL calculations effective from 9 August We would like to show you a description here but the site won’t allow us.SalaryPackagingPLUS is committed towards a greener and more sustainable future. Having embraced a paperless workplace by removing faxes and claim submissions via postal mail, we have streamlined our processes to enable you to submit information through our digital channels, including the MySalPack Mobile App and MySalPack Portal.Through this, we are proud .

Loading. ×Sorry to interrupt. CSS ErrorSTSL component = $1,095.99 × 2% = $22.00 rounded to the nearest dollar. 2 Employee has claimed the tax-free threshold and has fortnightly earnings of $2,355.78. Weekly equivalent of $2,355.78 = $1,177.99 ($2,355.78 ÷ 2, ignoring cents and adding 99 cents) Weekly STSL component = $1,177.99 × 3% = $35.00 rounded to the nearest dollar.

Installation. To download styled-components run: npm install styled-components That's all you need to do, you are now ready to use it in your app!

stsl component|Changes to STSL calculations effective from 9 August

PH0 · When to work out the study and training support loans component

PH1 · Tax scales, STSL rates, and SG changes in 2022

PH2 · Study and training support loans monthly tax table

PH3 · Study and training support loans fortnightly tax table

PH4 · Statement of formulas for calculating study and training support

PH5 · STSL tax explained: payroll guide for employers

PH6 · STSL Tax Explained: Payroll Guide for Employers

PH7 · STSL Tax Explained: Payroll Guide for Employers

PH8 · How is STSL calculated in the pay run? – Your Payroll (AU)

PH9 · How is STSL calculated in the pay run? – Your Payroll

PH10 · Changes to STSL calculations effective from 9 August